You are one step closer to finding the best mortgage in Spain

We have been negotiating with banks for years, helping our customers get the best mortgage on the Spanish market at no cost. At gibobs.com, our team of expert mortgage advisers will be by your side, guiding you through the fine print to help safeguard your financial health.

The first step is to explore your mortgage options. Fill out the form to get started, commitment-free.

Shall we start? Fill in the form and you will access a safe environment to simulate your mortgage

Why are we experts in mortgages?

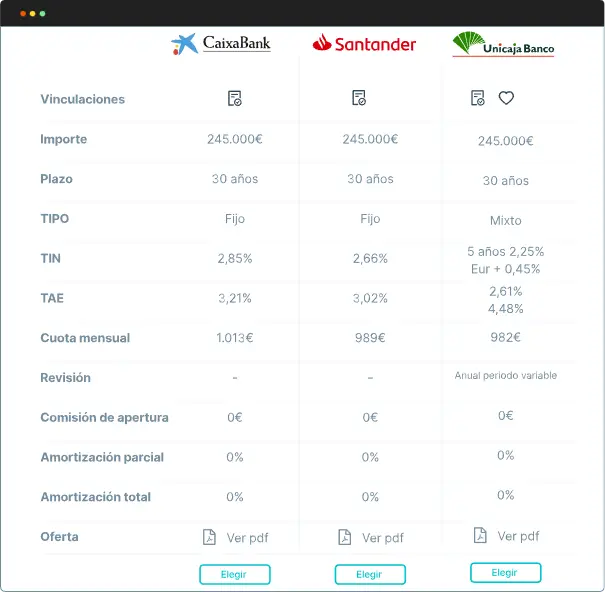

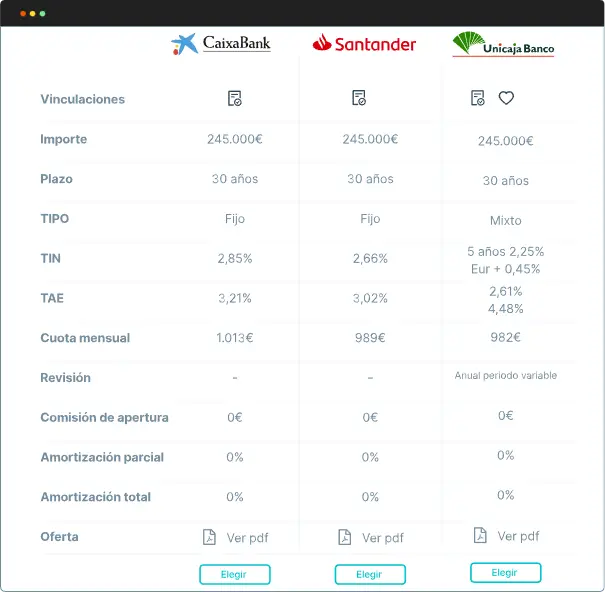

We work with the main banks in the country

No last minute commissions

Start by running a free simulation of your mortgage, in which we will show you an estimate of the interest rates that we could get you. If, after carrying out the simulation of your mortgage, you decide to work with us to offer you a personalized advisory service to help you get those offers, you won´t have to make any kind of payment: neither before nor during nor after the operation.

More information

Testimonials from real customers

82.50% of our customers surveyed would recommend us.**

**Data based on NPS survey

(*) Only for mortgages in Spain. In April 2025, one of our partner banks sent us an offer starting at 1.60% NIR with a fixed interest rate, requiring direct deposit of salary and the purchase of home and life insurance. This applied to a minimum mortgage amount of €300,000 and a household income exceeding €50,000 per year. The resulting APR was 2.92%. The APR calculation was based on a loan amount of €325,000 and included 1% discounts depending on the linked products: 0.40% for direct deposit of salary, 0.10% for home insurance, 0.40% for life insurance, and 0.10% for payment protection insurance. Regarding mixed mortgages, in March 2025, one of our partner banks sent us their best offer: a 1% fixed NIR for the first 5 years, followed by Euribor + 0.40% NIR. For minimum disposable income of €3,000/month, mortgages exceeding €500,000, with direct deposit of salary via credit card, and taking out home and life insurance and a pension plan. Debt-to-income ratio below 35%. In all these cases, whether fixed or mixed interest, the granting of any mortgage loan is subject to the discretion of the financial institutions and must be mortgages for the purchase of homes by individuals residing in Spain with income and assets held solely in euros. The simulation results will be obtained from the data you provide in the simulator and therefore do not constitute a contract offer and are not binding. Any decisions you may make based on these results are not the responsibility of Gibobs S.L. These conditions are not considered pre-contractual information; the granting and final terms of the mortgage always depend on the approval of the financial institutions. Gibobs SL is registered in the Register of Real Estate Credit Intermediaries.

Shall we start? Fill in the form and you will access a safe environment to simulate your mortgage