Mortgages for Non-Residents in Spain

Spain is a popular destination for people worldwide, whether for its sunny beaches, rich cultural heritage, or vibrant lifestyle. Among the many attractions, the Spanish property market stands out, offering lucrative investment opportunities and the chance to own a dream home in a picturesque locale. However, the process of obtaining a mortgage as a non-resident can be complex and requires a thorough understanding of local regulations and financial practices. This article provides a comprehensive guide to securing a mortgage in Spain for non-residents.

What are non-resident mortgages?

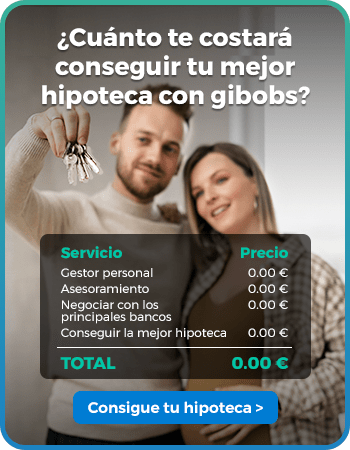

A non-resident mortgage in Spain is a loan offered to individuals who do not reside in the country for more than 183 days a year. These mortgages are tailored to meet the needs of foreign investors or those looking to purchase a holiday home. While similar to resident mortgages, they come with specific conditions and criteria reflecting the perceived higher risk associated with lending to non-residents. At gibobs we have spent years negotiating with banks, but this has only just begun: we have set the objective of helping people like you find the home of their dreams so if you are thinking of buying a home in Spain and you live abroad, contact us. We’ll help you for free.

Conditions of a non-resident mortgage

Mortgages for foreigners could have worse conditions than those offered for those residing in Spain. The main reason is that a Spanish bank is taking more risks in lending you the money. To compensate for this risk, stricter conditions apply:

Eligibility criteria

- Financial stability: Lenders require proof of a stable and sufficient income. This can include salary slips, tax returns, and bank statements.

- Credit history: A good credit history is essential. Spanish banks will typically conduct a credit check in your home country.

- Age: Generally, the age limit for mortgage applicants is between 18 and 65 years.

- Property valuation: The property must be appraised by a bank-approved valuer to determine its market value.

Loan-to-Value Ratio (LTV)

For non-residents, the LTV ratio is usually lower compared to residents. While residents might secure a mortgage covering up to 80% of the property’s value, non-residents can typically expect a maximum of 60-70%. This means a higher initial deposit is required.

Interest rates

Interest rates for non-resident mortgages can be higher due to the increased risk. Spanish mortgages may come with fixed or variable interest rates, with the latter being linked to the Euribor (Euro Interbank Offered Rate).

Repayment terms

Mortgage terms for non-residents can range from 5 to 25 years. The repayment period can significantly affect monthly payments, so it’s essential to choose a term that aligns with your financial situation.

Additional costs

When purchasing a property in Spain, several additional costs must be considered:

- Taxes: Property transfer tax (6-10%) and VAT (10% for new properties).

- Notary fees: For the official signing of the mortgage and property deeds.

- Property registry fees: For registering the property in your name.

Legal fees: Hiring a lawyer to ensure all paperwork and procedures comply with Spanish law.

That is why at gibobs we always recommend putting yourself in the hands of professionals who have experience negotiating with banks, such as our advisors, only then can you ensure that you get the best conditions for your mortgage.

Steps to obtain a non-resident mortgage

- Research and preparation: Understand the market and gather all necessary documents, including proof of income, credit history, and identification.

- Choose a lender: At Gibobs we help people like you to get the best mortgage conditions in Spain. You will always have the advice of our team of mortgage experts who will negotiate for you with the banks, and will pay zero fees neither before nor during nor after.

- Get a pre-approval: Obtaining a pre-approval letter from the bank can strengthen your position when negotiating the property price.

- Property valuation: Once you’ve selected a property, the bank will require a professional valuation.

- Submit the application: Provide all required documentation to the lender.

- Approval and signing: Upon approval, the mortgage contract will be signed in the presence of a notary. This is when the mortgage terms become legally binding.

- Property registration: Finally, the property must be registered in your name at the local Property Registry.

At gibobs.com we have expert advisors in contracting mortgages and we are in contact with the main banks to obtain the best conditions for your mortgage loan. Contact us without obligation and get the home you have always wanted in Spanish territory.